Research

We want to improve people’s life chances and identify ways to address disadvantage and inequality in our digitally driven society. Nuffield Foundation research provides independent evidence on topics that affect people’s daily lives and their well-being.

We provide access to outputs from all our research projects and work to strengthen their collective impact.

COVID-19

Nuffield-funded social scientists are conducting COVID-19 research in real-time, to capture people’s experiences of the social, cultural and economic impacts of the pandemic.

The changing face of early childhood

We have launched a new series to bring together the research evidence on early childhood in the UK.

Our research projects

12 of 559 results

Filter

Education | 2025 – 2026 New

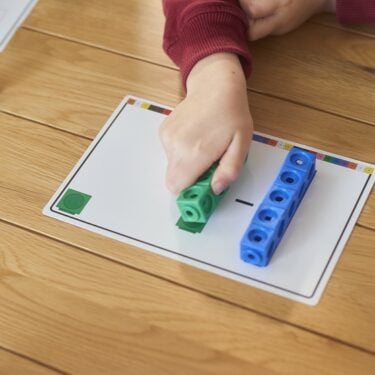

Investigating performance across Key Stage 2 maths topics

View project

Welfare | 2024 – 2027 New

Social security in a devolved UK

View project

Welfare | 2024 – 2027 New

Gypsy, Roma, Traveller Youth: mitigating exclusions using the digital?

View project

Justice | Welfare | 2024 – 2026 New

Challenging justice inequalities with children in conflict with the law

View project

Justice | 2024 – 2026 New

Special guardianship families: experiences and support needs

View project

Education | 2024 – 2026 New

Exploring academic selection and grammar schools in Northern Ireland

View projectThe Nuffield Foundation is not simply an academic funding body, though the research we fund must stand up to rigorous academic scrutiny. We want the policies and institutions that affect people’s well-being to be influenced by robust evidence.